Peter Berezin will be joining us soon for an interview. We just have to pin down a date with the Chief Global Strategist of BCA Research.

In the meantime, we’ve got excerpts from his latest report entitled How Much Economic Damage Will the Pandemic Cause?

Berezin examines the labour force, bankruptcies, fiscal stimulus and other factors using instructive charts to come to a conclusion for investors.

Here are the hi-lights from Berezin’s report:

For now, there is little evidence that the pandemic has adversely affected the global economy’s long-run growth potential.

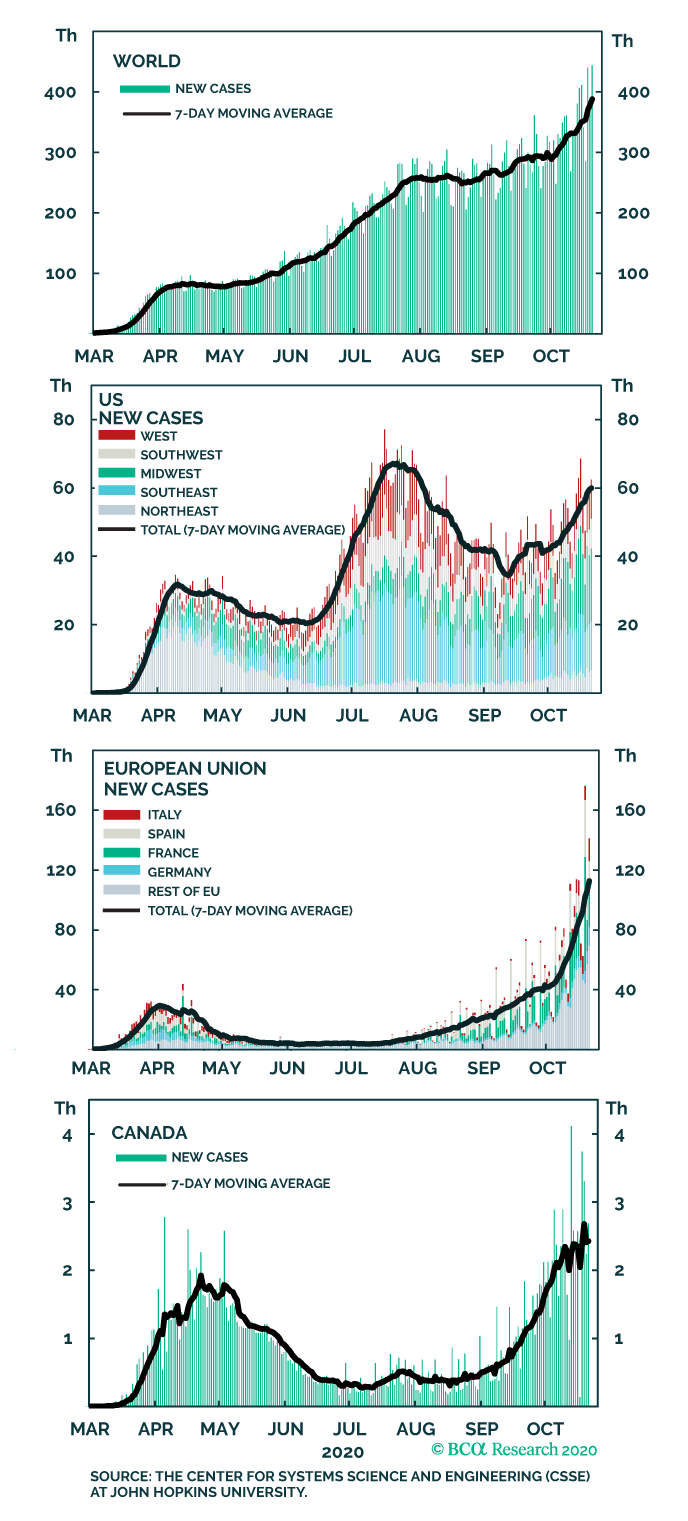

Of course, the pandemic is not yet over. The number of new cases continues to rise in the US and globally (Chart 5). The only saving grace is that mortality and morbidity rates are lower than they were earlier this year.

Nevertheless, many more people are likely to die or suffer debilitating long-term consequences before a vaccine becomes widely available.

Using the US as an example, if the total number of people who end up dying or getting so sick that they are unable to work ends up being twice what it is so far, the pandemic will reduce the labor force by about 240,000.

This is not a small number in absolute terms. However, it is less than 0.15% of the overall size of the US labor force, which stood at 164 million on the eve of the pandemic.

The impact of the pandemic on the labor forces of other major economies such as Europe, China, and Japan will be even smaller.

Chart 5

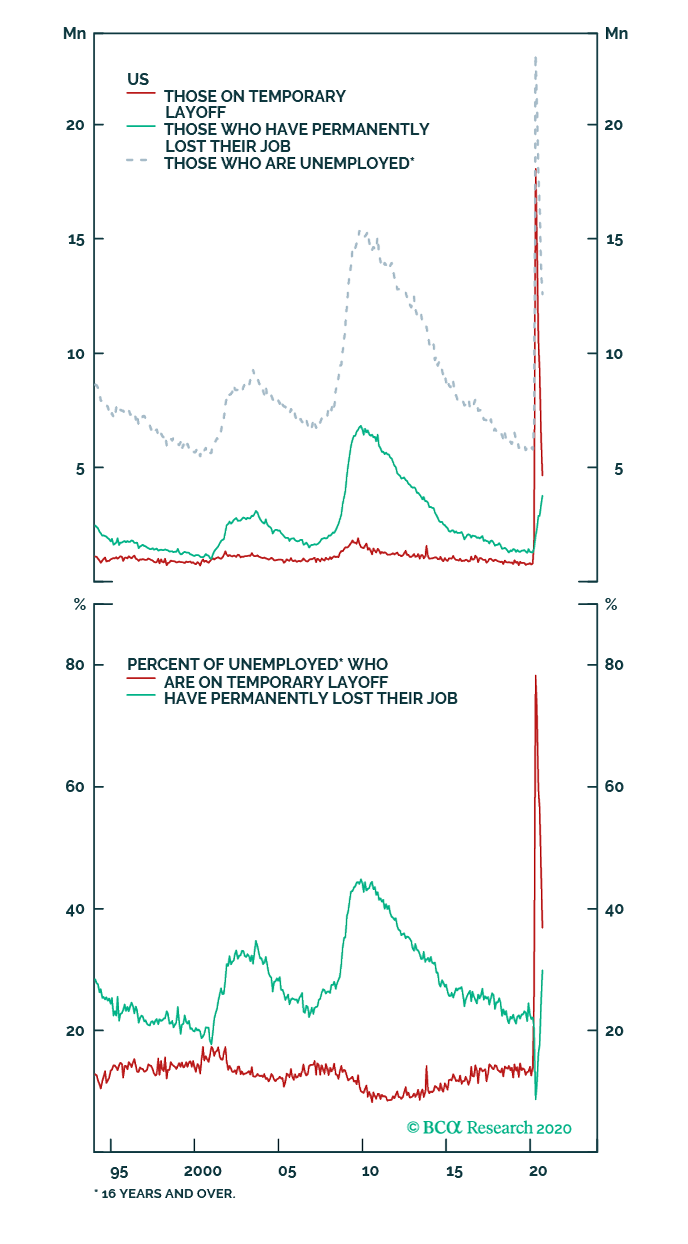

Admittedly, not everyone will have a job to return to. While about a third of US unemployed workers are still on temporary layoff, the number of workers who have suffered permanent job losses has been steadily rising (Chart 6).

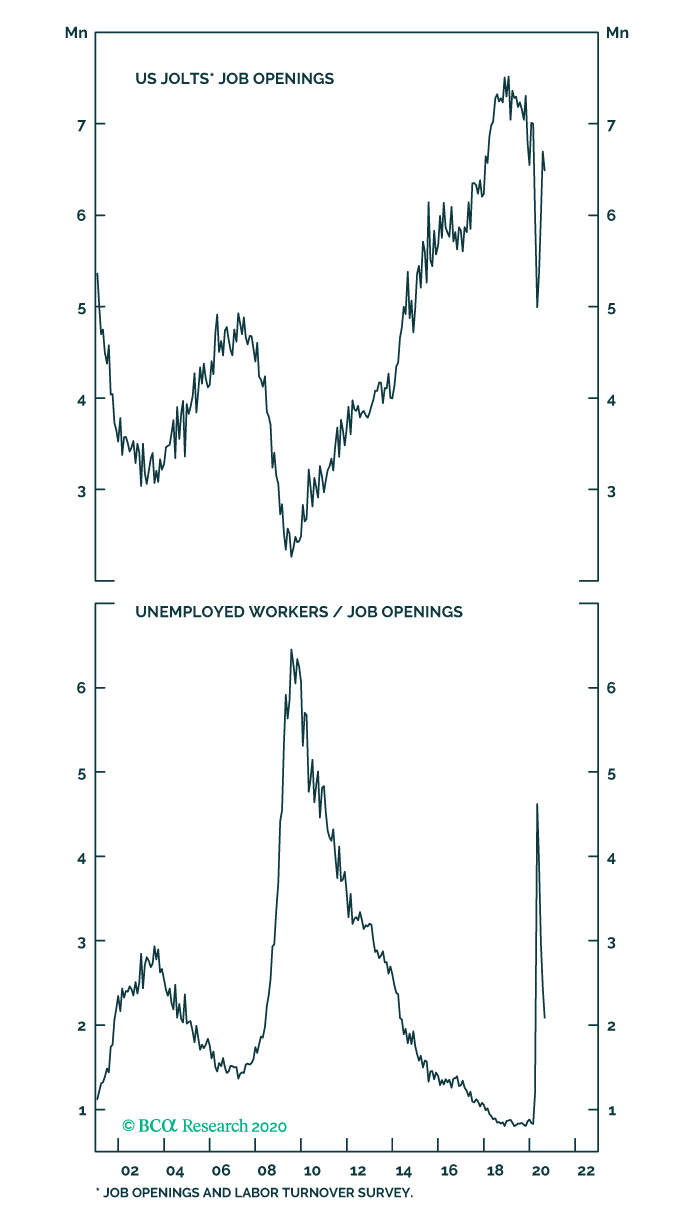

The good news is that job openings have recovered most of their decline since the start of the year. Unlike in mid-2009, when there were 6.5 unemployed workers for every one job vacancy, today there are only two (Chart 7).

Chart 6 & 7

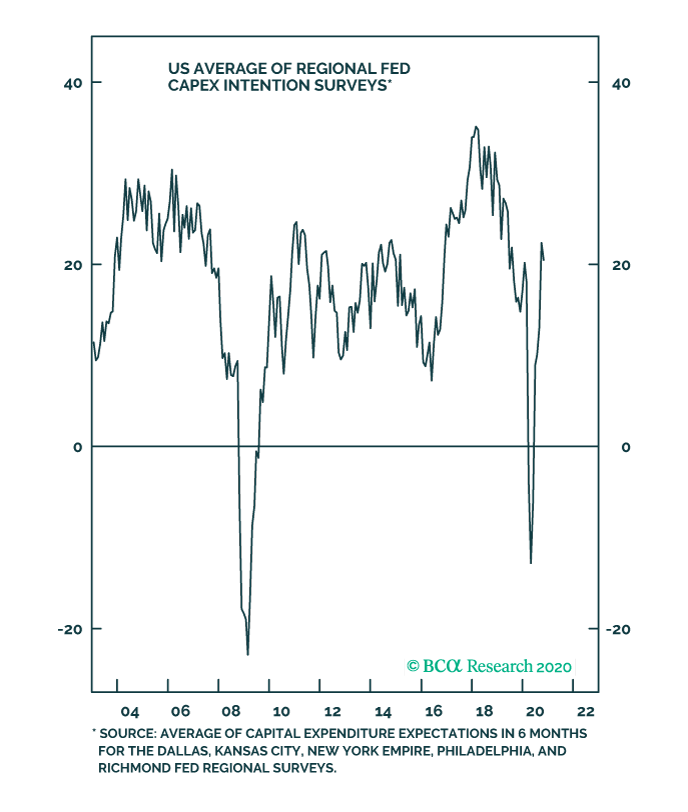

According to the Atlanta Fed’s GDPNowmodel, investment in equipment and IP is set to increase by 23% in the third quarter. The snapback in the Fed’s capex intention surveys suggests that investment spending should continue to rise in the fourth quarter and into next year (Chart 10).

Chart 10

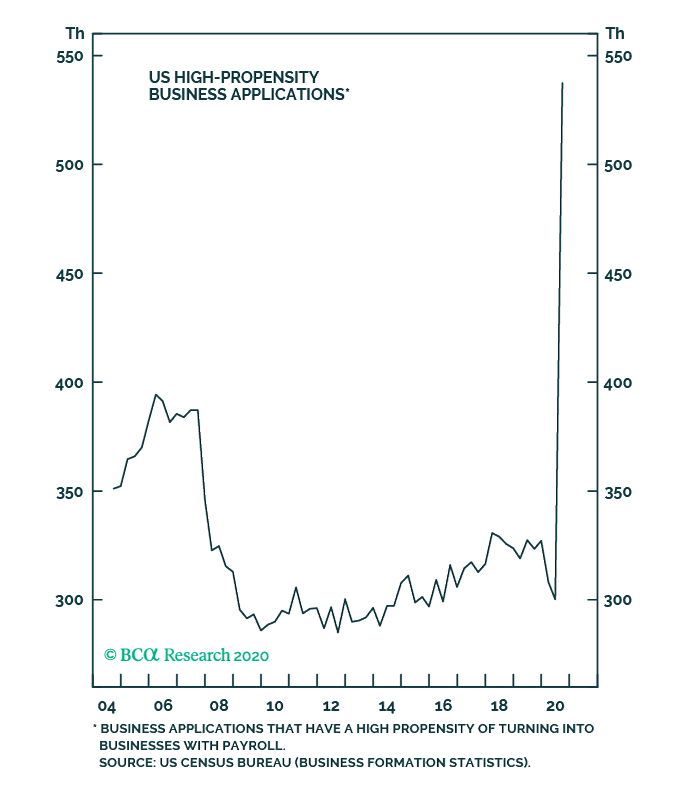

After dropping by 25%, the number of active US small businesses has rebounded to last year’s levels. New business applications have surged to record highs (Chart 11).

After dropping by 25%, the number of active US small businesses has rebounded to last year’s levels. New business applications have surged to record highs (Chart 11).

According to the American Bankruptcy Institute, commercial bankruptcy filings remain near historic lows.

Chart 11

Investors should continue to overweight equities for the time being. With a vaccine on the horizon, it makes sense to shift from favouring “pandemic plays” such as tech and health care stocks to favoring “reopening plays” such as deep cyclicals and banks.

A more cautious stance towards stocks will be appropriate later this decade if, as flagged above, a stagflationary environment leads to higher interest rates and slower growth.

Image source: www.ottawacitizen.com

Related stories: Q4 Strategy Outlook: “Post-Pandemic Regime Shift”