BCA Research is recommending a tactical trade it plans to close in three-to-six months. The idea is based on China government policy, and the movement of cyclical stocks.

Another sector is less affected and could be a profitable offset to the other side of this trade. Here are some excerpts from BCA’s report.

**

China’s credit & fiscal impulse has rolled over. If history is any guide, this could reduce momentum in Chinese manufacturing activity.

Given that China is a dominant consumer of metals, the price of bulk and base metals could also suffer.

Ongoing efforts by the authorities to restrain “speculative” activity in Chinese commodity markets may further weigh on metals prices. Global metals prices tend to track the performance of Chinese cyclical stocks versus defensives. Chinese cyclicals have hooked down recently, which is a red flag for metals.

With all that in mind, we are downgrading our 12-month view on bulk and base metals from overweight to neutral.

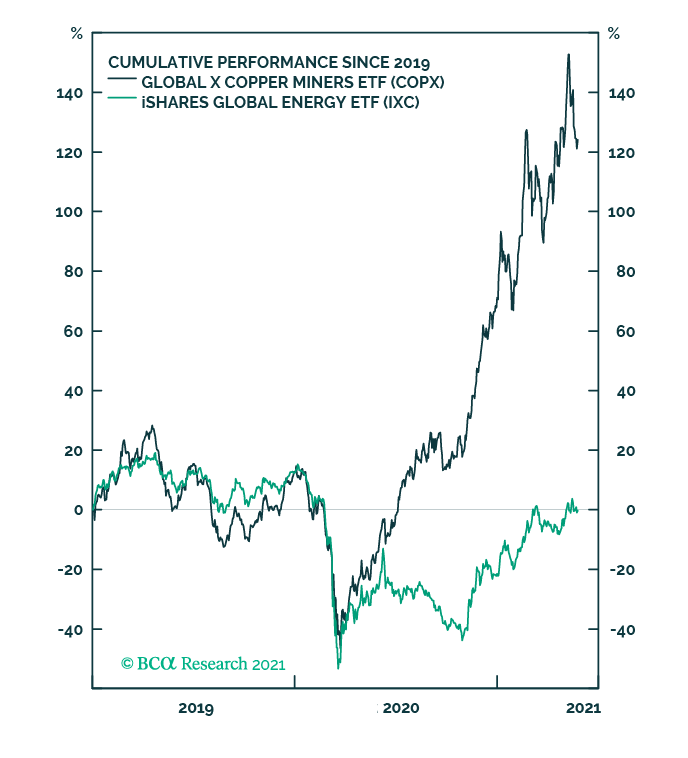

As a tactical trade, we are also recommending going short the Global X Copper Miners ETF (COPX) versus the iShares Global Energy ETF (IXC).

Unlike copper, oil demand is less sensitive to the vagaries of the Chinese economy. We expect to close the trade in three-to-six months.

Related stories: Are We Entering the Next Commodities Super-Cycle?